Finding a good mutual fund is easier to said than done. You need to know customers needs and where he’s coming from. And, also you have to compare between multiple mutual funds to find which is most suitable for you customer.

Disclaimer: The images and fund names in this article are used solely for illustrative purposes. We do not endorse any mutual fund schemes or platforms. The fund categories and specific funds were chosen at random and in no particular order.

Before advising any fund to a investor there are some key information which needs to be known about the investor. These key informations are as follows:

- Age: Younger investors generally have a higher risk tolerance; older investors typically prefer lower-risk investments.

- Goals: Investment objectives like retirement, education funding, or wealth accumulation influence risk tolerance.

- Financial Situation: Analysis of income, savings, debt levels, and overall financial health.

- Investment Experience: More experienced investors may tolerate higher market volatility.

- Psychological Level: Personal comfort levels with potential losses and market fluctuations.

After finding the necessary information about the investor, Now we can look for a suitable fund for him. In this article, we’ll take an example of a 55 years old conservative investor.

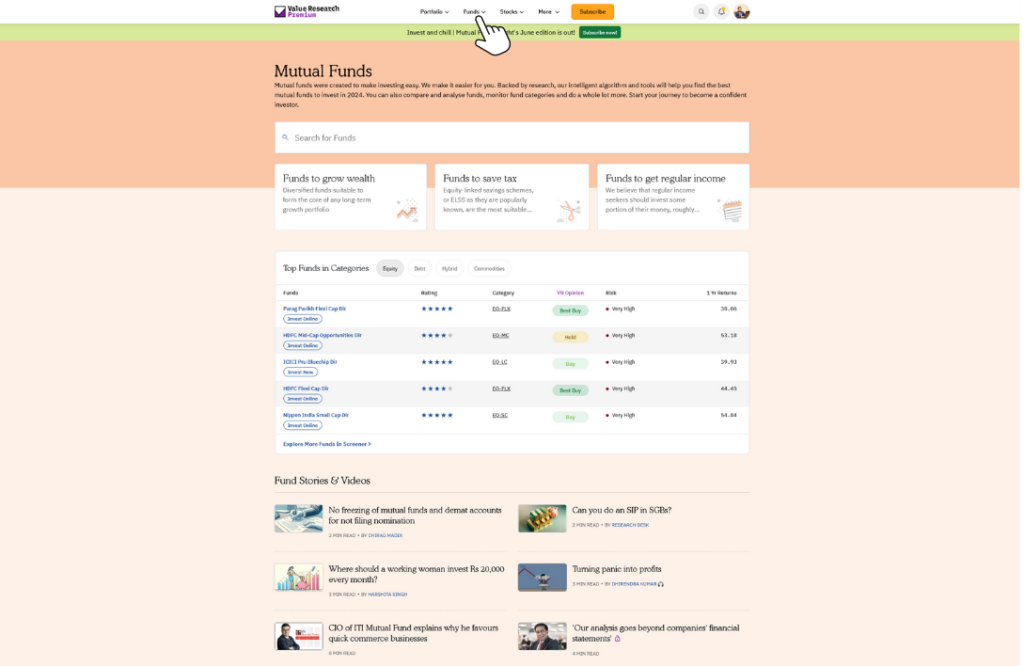

Step 1: Visit Value Research Online

Go to the Value Research website to access comprehensive fund data and click on Funds as shown in the image below.

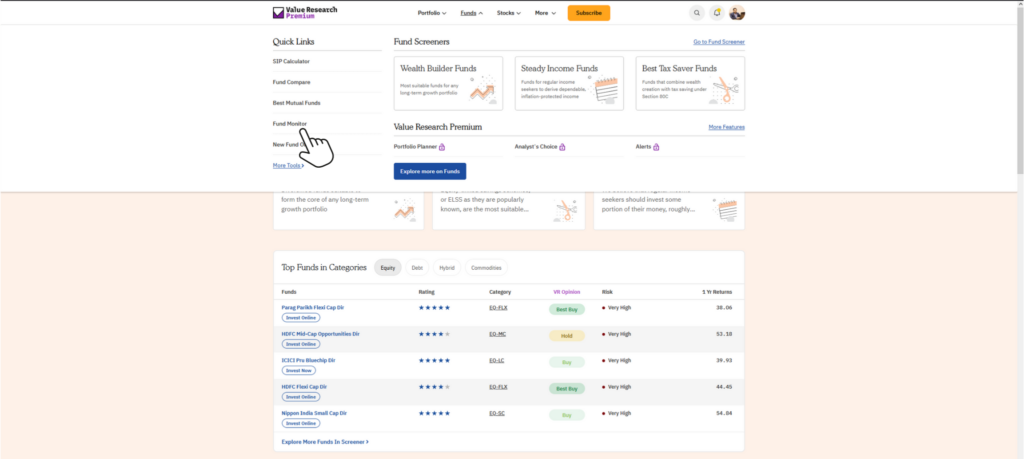

Step 2: Click on the Fund Monitor

Refer to the screenshot below.

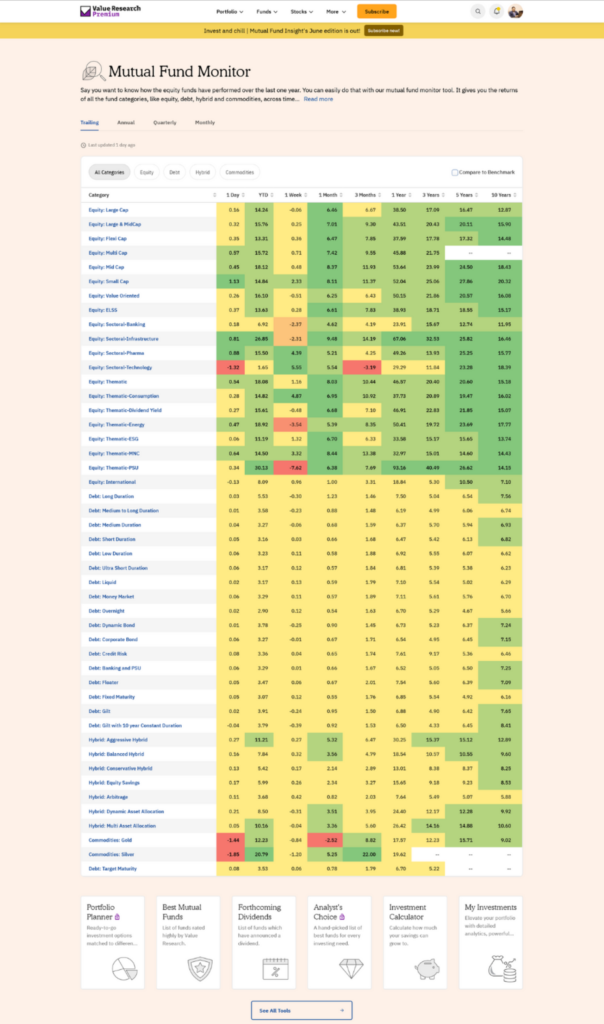

Step 3: Select a category from the options below for comparison and review.

For instance, let’s choose the Large-Cap Category.

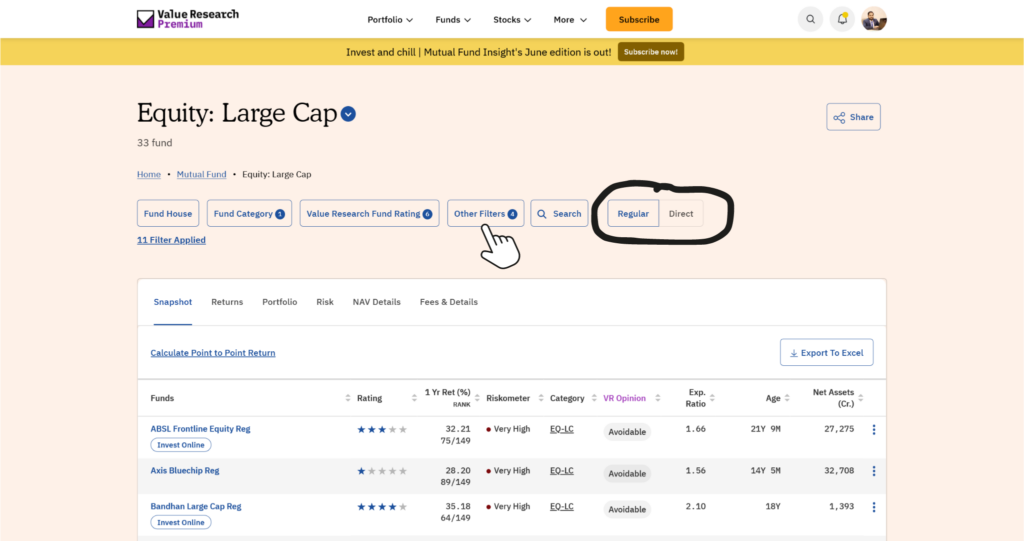

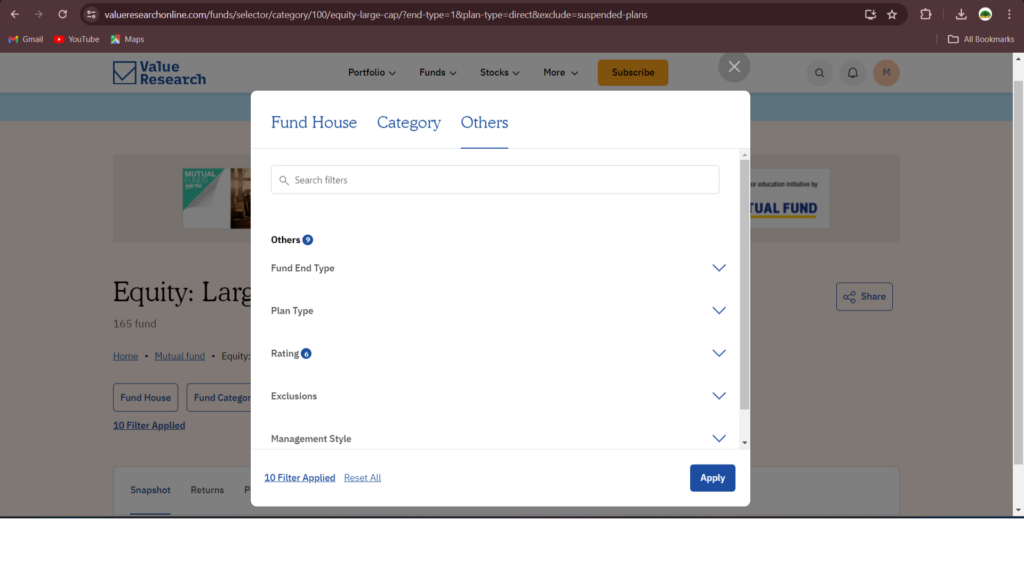

Step 4: Use the Other Filters to narrow down the search.

Find the most suitable funds with the help of available filters. Make sure that “Regular” is selected (Note: Currently, we do not offer direct funds.)

Step 5: A Dialog Box would appear as shown.

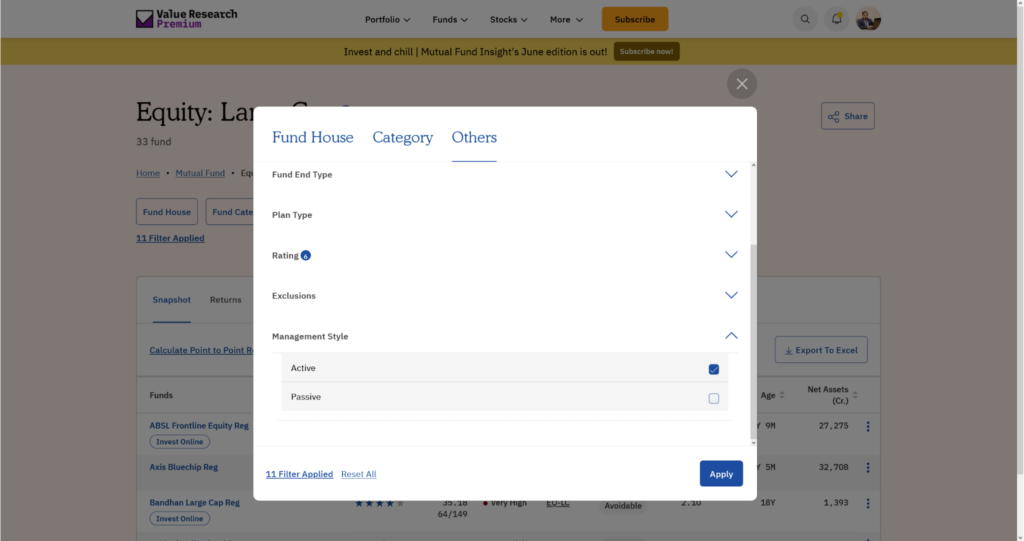

Step 6: Choose Management Style.

Choose Active and click on Apply as shown below.

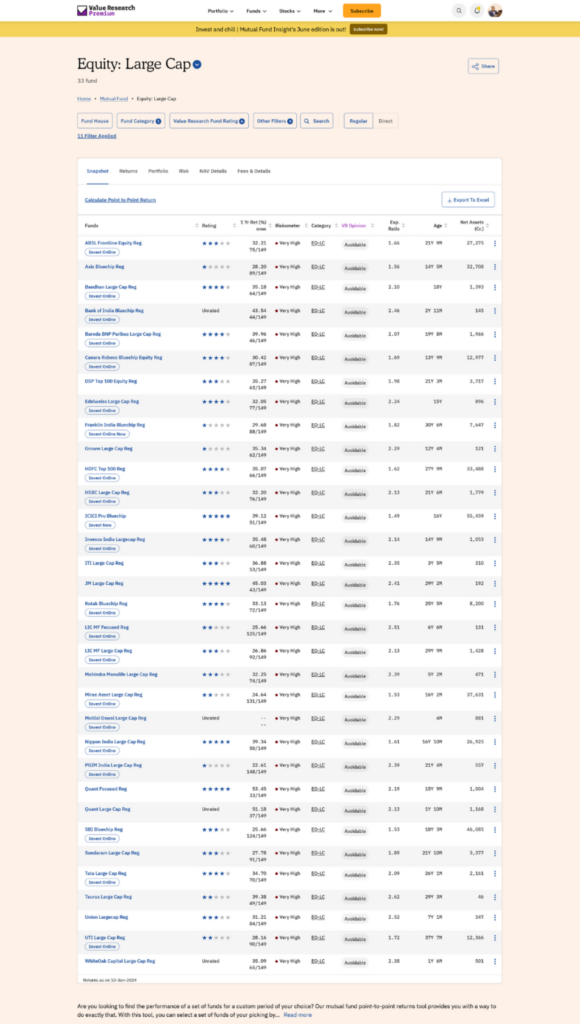

Step 7: Wait for data to load.

The list will display all the funds in the selected category (e.g., Large-Cap).

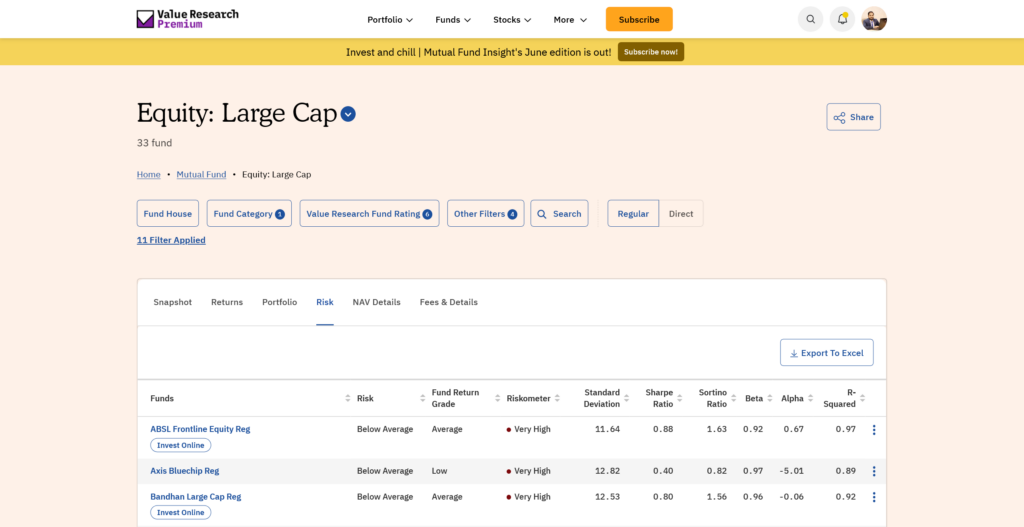

Step 8: Select Risk

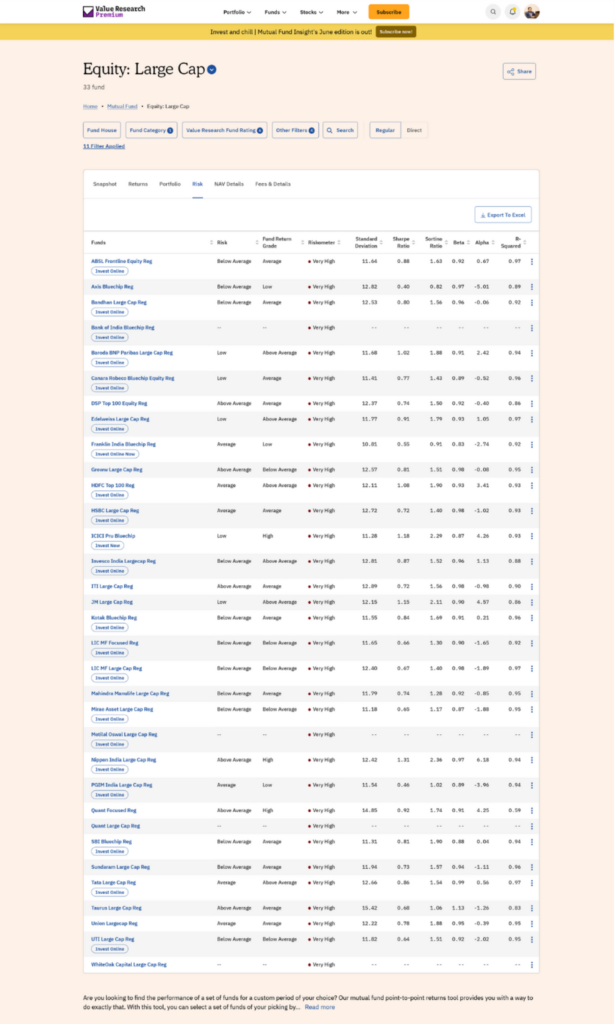

Similarly, The list will display all the funds with their risk profile in the selected category (e.g., Large-Cap).

Step 9: Compare the first two funds.

To choose between Fund A and Fund B, we’ll look at several key metrics: standard deviation, Sharpe ratio, Sortino ratio, beta, alpha, and R-squared. These metrics help us understand how each fund performs and the risks involved.

Fund Matrics

Fund A:

- Standard Deviation: 11.64

- Sharpe Ratio: 0.88

- Sortino Ratio: 1.63

- Beta: 0.92

- Alpha: 0.67

- R-Squared: 0.97

Fund B:

- Standard Deviation: 12.82

- Sharpe Ratio: 0.40

- Sortino Ratio: 0.82

- Beta: 0.97

- Alpha: -5.01

- R-Squared: 0.89

What These Metrics Mean

- Standard Deviation: Measures how much the fund’s returns vary. Lower is better because it means less risk.

- Implication: Fund A is less risky than Fund B.

- Sharpe Ratio: Shows how well the fund returns compared to its risk. Higher is better.

- Implication: Fund A (0.88) gives better returns for the risk taken than Fund B (0.40).

- Sortino Ratio: Similar to Sharpe but only looks at bad risks. Higher is better.

- Implication: Fund A (1.63) is better at handling downside risk than Fund B (0.82).

- Beta: Measures how much the fund moves with the market. A beta of 1 means it moves exactly with the market.

- Implication: Fund A (0.92) is a bit less sensitive to market changes than Fund B (0.97).

- Alpha: Shows how well the fund performs compared to its benchmark. Positive alpha is better.

- Implication: Fund A (0.67) outperforms its benchmark, while Fund B (-5.01) underperforms.

- R-Squared: Measures how much of the fund’s movement can be explained by the market. Closer to 1 means it follows the benchmark well.

- Implication: Fund A (0.97) tracks its benchmark better than Fund B (0.89).

Which Fund to Choose?

- For Conservative Investors: Fund A is preferred due to its lower risk, better returns compared to risk, and positive alpha.

- For Aggressive Investors: Fund A is preferred, even with a higher risk appetite, Fund A’s better returns for the risk and positive alpha make it more appealing.

- For Balanced Investors: Fund A is preferred, it balances return and risk well, making it suitable for those who want a bit of both.

What this mean is Fund A is the better choice for all types of investors because it offers better risk-adjusted returns, lower risk, positive alpha, and good tracking with its benchmark. Fund B’s negative alpha and lower performance metrics make it less appealing.

Disclaimer: The views expressed here are of the author and do not reflect those of Dhanvantree. Mutual funds are subject to market risks, please read the scheme documents carefully before investing.