Union Budget 2025: What You Need to Know About Tax Changes

Introduction

The 2025 Union Budget has introduced significant changes to India’s tax system, impacting both personal finance and broader economic growth. The increase in the tax-free income limit to Rs 12 lakh under the new regime—effectively Rs 12.75 lakh for salaried individuals—marks one of the biggest tax cuts in recent years. While this move increases disposable income, it also raises concerns about its long-term effects on savings and investments.

Key Highlights of Union Budget 2025

The Union Budget 2025 focuses on tax simplification, economic growth, and fiscal consolidation. Key highlights include:

- Tax Reforms: The new tax regime offers 100% tax relief for incomes up to ₹12 lakh and additional savings at higher income levels.

- Fiscal Deficit Target: Reduced to 4.4% of GDP in FY26, ensuring fiscal prudence.

- Capital Expenditure: Growth has moderated to 10% YoY, prioritizing infrastructure projects.

- Industry Boost: IFSC (GIFT City) tax incentives, MSME classification changes, and ease of doing business reforms.

- Indirect Tax Reforms: Custom duty reductions on lithium-ion batteries, semiconductors, and life-saving drugs.

- Investment Reforms: Central KYC registry revamp to simplify investor onboarding.

These reforms collectively aim to increase disposable income, drive consumption, and stimulate sectoral growth while maintaining fiscal discipline.

Impact of Union Budget 2025 on Tax-Saving Investments

Union Budget 2025 aims to simplify the tax structure and increase disposable income, providing a much-needed relief for many. However, the lock-in periods associated with traditional tax-saving instruments like EPF, PPF, NPS, and ELSS have historically acted as a built-in mechanism for financial discipline, helping investors learn about market fluctuations, volatility, risk, and long-term returns. For instance, someone investing in ELSS must stay invested for at least three years, fostering an understanding of market cycles and wealth-building strategies. While the immediate benefits of increased disposable income are clear, without these tax incentives, there is a risk that investors might focus more on short-term spending rather than structured financial planning.

Fiscal Discipline and Deficit Targets

A key focus of Budget 2025 is maintaining fiscal discipline while ensuring sustainable economic growth:

- Fiscal Deficit Target: Reduced to 4.4% of GDP in FY26 from 4.8% in FY25 (Revised Estimates).

- Capital Expenditure Growth: Slowed to 10% YoY, indicating a cautious approach to infrastructure spending.

- Reduction in Subsidies: Down to 1.1% of GDP in FY26 from 1.2% in FY25.

- Personal Income Tax Revenue Growth: Projected at 14.4%, outpacing overall gross tax revenue growth of 10.8%.

Major Tax Reforms and Reliefs in Union Budget 2025

The budget introduces bold tax reforms aimed at increasing disposable income and simplifying tax compliance:

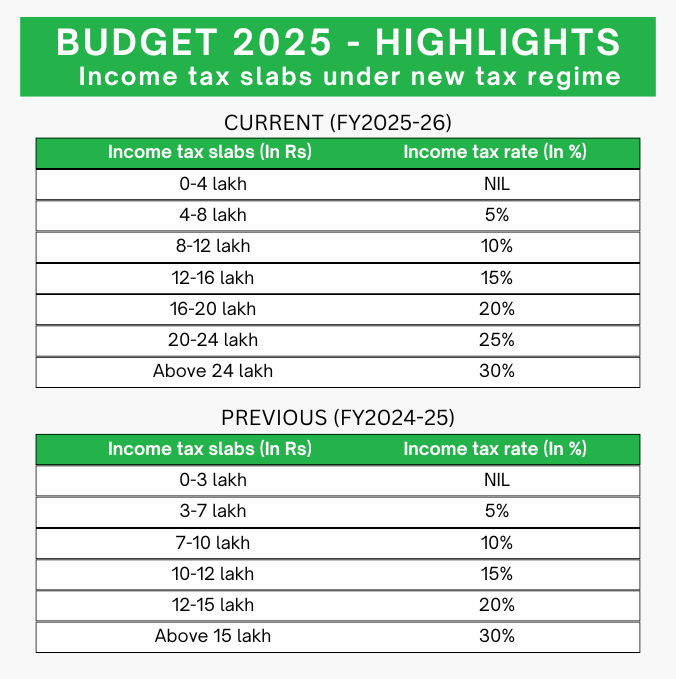

New Income Tax Slabs:

- No tax payable on income up to ₹12 lakh (₹12.75 lakh for salaried individuals with the standard deduction).

- Tax savings at different income levels:

- ₹12 lakh income: ₹80,000 saved (100% relief).

- ₹18 lakh income: ₹70,000 saved (30% relief).

- ₹25 lakh income: ₹1,10,000 saved (25% relief).

TDS/TCS Rationalization:

- Rent exemption threshold: TDS now applies on rent above ₹6 lakh per year (earlier ₹2.4 lakh).

- Senior Citizen Interest Income Exemption: Increased to ₹1 lakh (from ₹50,000).

- Liberalized Remittance Scheme (LRS): TCS threshold raised from ₹7 lakh to ₹10 lakh.

Impact on Tax-Saving Investments

While the budget simplifies taxation and increases disposable income, it reduces incentives for traditional tax-saving investments such as EPF, PPF, NPS, and ELSS. These instruments have historically encouraged disciplined saving and long-term wealth creation. The removal of tax incentives could lead to:

- A shift in investor behavior towards short-term consumption rather than structured financial planning.

- A decline in long-term savings, which may impact retirement preparedness and wealth accumulation.

- Reduced participation in equity-linked tax-saving schemes like ELSS, affecting market liquidity and investment growth.

Central KYC Registry: Making Investments Easier

A key highlight of Union Budget 2025 is the revamp of the Central KYC Registry, set to launch in 2025. Currently, investors must complete multiple KYC processes across financial institutions, leading to inefficiencies and delays. A unified KYC system will streamline onboarding, reducing paperwork and enhancing financial inclusion. This initiative is expected to drive greater participation in financial markets, potentially counterbalancing the decline in tax-linked savings.

Economic Growth and Industry Focus

The budget outlines initiatives to boost economic growth across key sectors:

Economic Growth and Industry Focus: Enhanced tax incentives for IFSC companies to attract foreign investments and expand global financial services, strengthening India’s position as a financial hub.

MSME Support: Increased investment and turnover limits for MSME classification, along with easier credit access and government-backed financial support to boost growth and employment.

India Post Expansion: Transforming India Post to provide banking, insurance, and digital financial services, enhancing financial inclusion in rural areas.

Jan Vishwas Bill 2.0: Decriminalizing over 100 legal provisions to reduce regulatory burdens, encouraging entrepreneurship, and fostering a pro-business environment.

Indirect Tax Proposals

The budget also introduces key changes in indirect taxation to support industry growth:

- Custom Duty Cuts:

- Exemptions on raw materials, chemicals, lithium-ion batteries, and semiconductors.

- Lower tariffs for motorcycles (previously 50%/25%/15%, now reduced to 40%/20%/10%).

- Healthcare Support:

- 36 new life-saving drugs (for cancer, rare diseases) added to the duty-free list.

Sectoral Implications in Union Budget 2025

| Sector | Impact |

|---|---|

| Automobile | Positive: Tax relief boosts demand for two-wheelers and four-wheelers. EV sector benefits from custom duty cuts on lithium batteries. |

| Oil & Gas | Negative: ₹1,500 crore LPG subsidy may be insufficient to cover OMC under-recoveries. |

| Aviation | Positive: Modified UDAAN scheme to expand air connectivity to 120 new destinations. |

| Banking/NBFCs | Positive: MSME credit guarantee raised to ₹100 million; ₹150 billion SWAMIH fund for stalled housing projects. |

| Insurance | Negative: FDI limit increased to 100%, leading to higher competition. |

| Fintech/Payments | Negative: UPI/RuPay incentives slashed from ₹20 billion to ₹4.4 billion. |

| Consumer Goods | Positive: Tax benefits drive urban consumption. |

| Infrastructure | Positive: Capex up 10% to ₹11.2 lakh crore |

| Real Estate | Mixed: Higher disposable income boosts property investment, but PMAY allocation is lower than FY25. |

| Defense | Positive: Capital budget up 13% YoY to ₹1.80 lakh crore. |

Adapting Investment Strategies for Union Budget 2025

While the budget offers greater disposable income, investors must plan for long-term financial stability. Countries with strong savings cultures use mechanisms like auto-enrollment in retirement plans, employer-matching contributions, and government-backed savings programs. India should explore similar policies to maintain disciplined investing habits. Investors should also consider diversifying into equity mutual funds and ETFs to maximize returns in the absence of traditional tax-saving incentives.

Conclusion

Union Budget 2025 presents a mix of opportunities and challenges. While tax reforms provide relief and increase disposable income, they also reduce incentives for long-term savings. A balanced approach—spending wisely while maintaining disciplined investments—will be key to long-term financial success.

Note: Mutual fund investments are subject to market risks. Read all scheme-related documents carefully before investing. The past performance of the schemes is neither an indicator nor a guarantee of future performance.

Budget 2025 presents both challenges and opportunities. While tax relief gives people more financial freedom, it also reduces the incentives for long-term savings. Having more disposable income is great, but investors must think ahead to ensure financial stability.

Leave a Reply